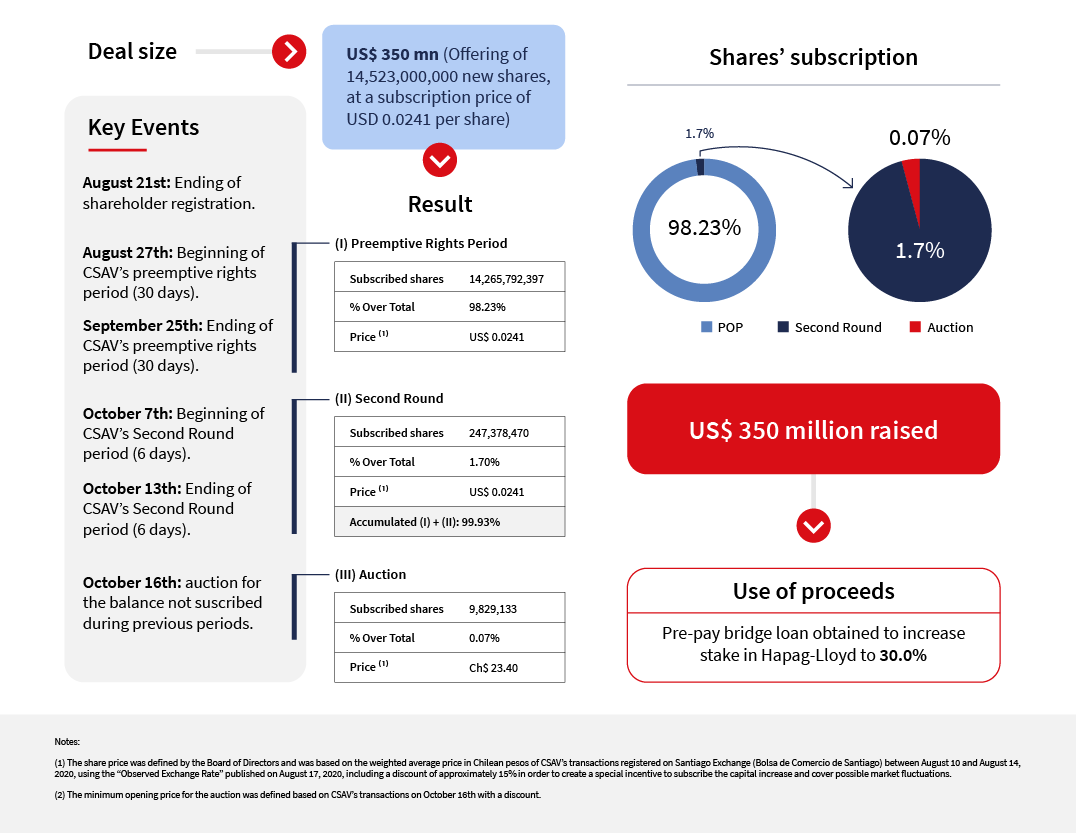

At an extraordinary shareholders’ meeting held on May 19, 2020, shareholders of Compañía Sud Americana de Vapores (CSAV) agreed to increase capital by US$350 million.

The funds raised in this capital increase were used to adjust CSAV’s financial debt level after investing US$450 million to acquire a 4.14% stake in Hapag-Lloyd to reach 30% in January 2020. This transaction was financed with a US$100 million bond issuance and US$350 million in bridge loans granted mainly by its controlling shareholder, Quiñenco. This capital increase of US$350 million has enabled the Company to pay down these bridge loans.

A total of 14,523 million shares were issued and offered preferentially to CSAV shareholders at a price of US$ 0.0241 per share.

Suscription stages:

- The Pre-emptive Rights Period (POP for its acronym in Spanish) began on August 27, 2020, and ended on September 25, 2020, thus complying with the 30-calendar-day requirement mandated by Chilean regulations. This stage was successfully concluded with 98.23% of the offering being subscribed, equivalent to around 14,266 million shares, and MUS$ 343.8 raised. After closing this process, the Company’s share capital as of September 30, 2020, totaled 51,062,668,585 fully subscribed and paid-in single-series shares with no par value.

- Subsequently, and in light of the considerable shareholder interest in their pre-emptive rights, the Company’s board decided to offer the remaining shares in a second pre-emptive rights period (known as the “Second Round”) that lasted six calendar days, concluding on October 13th with a final total subscription of 99.93% of all shares issued.

- Afterwards, to finalize the capital increase process, the unsubscribed balance of shares was offered to the market through two simultaneous open auctions on October 16, 2020, thus successfully raising the target funds of MMUS$ 350 for the capital increase.