Hapag-Lloyd publishes annual report and announces forecast for the current financial year

Hamburg, 10 March 2022

- Result significantly higher compared to prior year

- Proposed dividend of EUR 35 per share

- Very strong earnings trend expected to continue in the first half of 2022

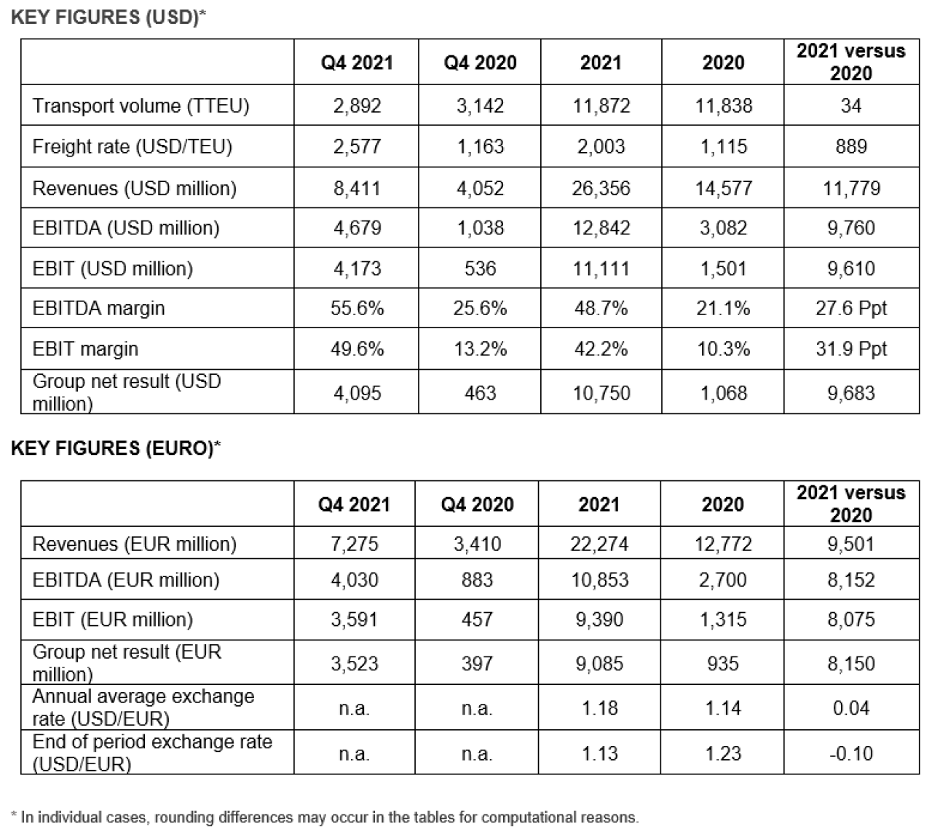

Hapag-Lloyd published its audited annual report for the 2021 financial year today. In the reporting year, Hapag-Lloyd’s EBITDA increased to slightly more than USD 12.8 billion (approximately EUR 10.9 billion). The EBIT rose to USD 11.1 billion (approximately EUR 9.4 billion), and the Group net result improved to around USD 10.8 billion (EUR 9.1 billion). The main drivers of these positive business developments have been significantly improved freight rates resulting from very strong demand for goods exported from Asia.

“We look back on an exceptionally successful year in which we invested massively in modern vessels and new containers. In addition, we have significantly strengthened our financial and asset position. However, transport expenses have unfortunately also risen significantly, mainly due to the bottlenecks in the global supply chains,” said Rolf Habben Jansen, CEO of Hapag-Lloyd AG.

Revenues increased to roughly USD 26.4 billion (approximately EUR 22.3 billion). This can mainly be attributed to a higher average freight rate of 2,003 USD/TEU (2020: 1,115 USD/TEU). Transport volumes were roughly on a par with the prior-year level, at 11.9 million TEU (2020: 11.8 million TEU) due to the strained supply chains. At the same time, transport expenses rose very significantly, by 17.1 percent, to USD 12.2 billion (EUR 10.3 billion). This was particularly due to higher bunker prices and charter rates as well as increased demurrage and storage fees.

In 2021, the net debt was completely paid off. At the end of the year, the liquidity stood at roughly USD 8.7 billion (approximately EUR 7.7 billion). It thereby significantly exceeded financial debt, with the result that Hapag-Lloyd had net liquidity of around USD 2.5 billion (EUR 2.2 billion) as of 31 December 2021.

In light of this very successful financial year, the Executive Board and Supervisory Board of Hapag-Lloyd AG have decided to propose to the Annual General Meeting that a dividend of EUR 35 per share be paid out for the 2021 financial year.

Looking ahead, Hapag-Lloyd expects earnings to be very strong in the first half of 2022. Moreover, it anticipates that the strained situation in the global supply chains will ease in the second half of the year, which should lead to a beginning normalisation of earnings. EBITDA is expected to be in the range of USD 12 to 14 billion (EUR 10.7 to 12.4 billion) and EBIT to be in the range of USD 10 to 12 billion (EUR 8.9 to 10.7 billion). However, this forecast remains subject to considerable uncertainty given the ongoing COVID-19 pandemic and current developments in Ukraine.

“The 2022 financial year has gotten off to a successful start for us, but the disruptions in the supply chains have not eased materially yet. In addition to that, we all face the terrible war in Ukraine. We stand united with the international community, have stopped our bookings to and from Russia, and call for de-escalation and peace,” Rolf Habben Jansen said, adding: “The safety and well-being of all of our employees continues to be our top priority – and we will also do whatever we can to provide humanitarian support.”

The detailed full-year 2021 figures, including explanatory notes relating to the performance measures EBITDA and EBIT referred to herein, can be found in the download section of the digital annual report: